Bob Iger, chief executive officer of The Walt Disney Co.

Patrick T. Fallon | Bloomberg | Getty Images

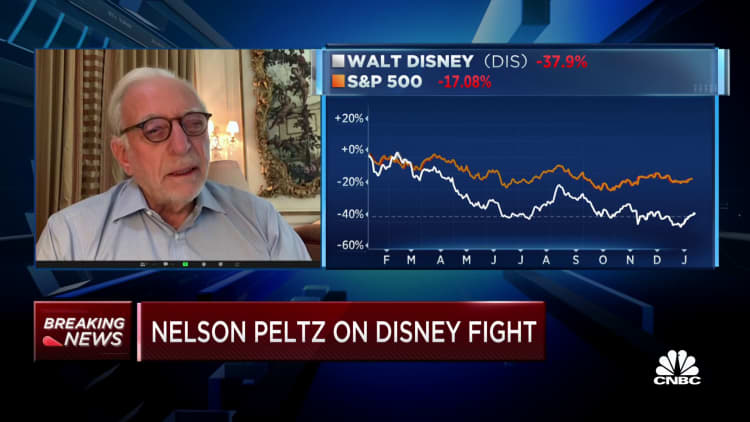

Activist investor Nelson Peltz spent about 30 minutes Thursday morning speaking with CNBC’s Jim Cramer and David Faber in a wide-ranging interview about why he wants a Disney board seat.

But his argument barely touched on what should be his strongest point — Disney’s consistent failure to plan for CEO succession.

Peltz referred to his fund’s slide presentation on Disney’s failures under the leadership of past CEOs Bob Iger and Bob Chapek. He said if he had to distill the presentation down to its core, it would revolve around Disney’s poor share performance and Trian’s track record of value creation. Trian noted that Disney’s share price peaked in 2021 but currently trades near its eight-year-low. The stock was up about 3% Thursday.

But Disney’s underperformance in 2022 mirrored an industry-wide slump led by Netflix‘s stalled growth. Disney’s share price spike in 2021 was caused by the same phenomenon — investors charging into streaming services with significant subscriber growth. Disney and Netflix are both down about 38% in the past 12 months. Other media stocks are down even more. Paramount Global shares have slumped 45%. Warner Bros. Discovery shares are down almost 50% since its AT&T merged WarnerMedia with Discovery on April 8.

Peltz blamed Disney Chief Executive Bob Iger and its board for overpaying for 21st Century Fox in 2019 for the company’s decision to scrap its dividend during the pandemic. But asking for a board seat based on Iger’s track record of acquisition decision making isn’t going to win over many investors. Iger’s string of deals during his tenure as CEO — acquiring Pixar, LucasFilm and Marvel — before Fox were some of the best acquisitions in the history of the media industry.

Trian also noted Disney’s “flawed direct-to-consumer strategy” in a filing “despite reaching similar revenues as Netflix and having a significant IP advantage.” Netflix launched its streaming business years before Disney debuted Disney+ in 2019. It’s natural that Netflix would be ahead of Disney (and every other streaming service) in terms of profitability and free cash flow generation.

Peltz plans to mount a proxy fight and his strongest argument to shareholders shouldn’t be about Iger’s performance as a CEO. Rather, it should be about the board’s consistent failure to plan for a post-Iger world. Iger developed a history during his initial, 15-year CEO tenure of chasing away potential successors, including Jay Rasulo, Tom Staggs and Kevin Mayer. When he did give up his CEO job in 2020, he failed to leave the company completely, setting up an 18-month stretch where his handpicked successor, Chapek, felt undermined by his presence.

Now Iger’s back, and the Disney board has tasked him with finding a successor in the next two years. Iger’s track record suggests succession planning is the one area where he really struggles.

“Iger has historically dominated the succession process, but it shouldn’t be Iger’s pick, it’s the board’s pick,” said Charles Elson, founding director of the Weinberg Center for Corporate Governance. “Disney left itself susceptible to activist intervention because it’s had governance issues with succession for almost 25 years.”

Part of Trian’s pitch to investors is the succession issue, but it doesn’t come up until slide 27 of a 35-slide presentation. Most of Peltz’s argument is based on Disney’s underwhelming share performance, the decision to scrap the dividend, how the Fox deal hasn’t worked, how a hypothetical deal for Sky (a deal that didn’t actually happen) wouldn’t have worked, and Trian’s history of boosting share value. He also told CNBC that Disney either needed to acquire Comcast’s 33% stake in Hulu or “get out of the streaming business.”

Disney is addressing the share slump of the past year by bringing back Iger, a generally well-respected CEO by both employees and investors. Disney will also soon have a new board chairman. Peltz’s argument that Iger needs Trian’s help with strategic decision-making just months into stepping back into the job may be a hard sell.

It’s a far easier case to be made that Disney’s board and Iger have consistently bungled succession planning. Trian said in its presentation that Disney’s shareholder engagement process has been “among the worst (if not the worst) of all the companies we have interacted with.”

It’s possible Disney doesn’t want Peltz on the board because he’ll force the issue of succession, limiting Iger’s ability to stay as CEO longer than two years. As Trian noted in its presentation (on Slide 28), the Disney board extended Iger’s retirement date five different times between October 2011 and December 2017.

Perhaps Peltz needs to refine his message to focus on that.

WATCH: Disney is more than a media company, says Trian’s Nelson Peltz