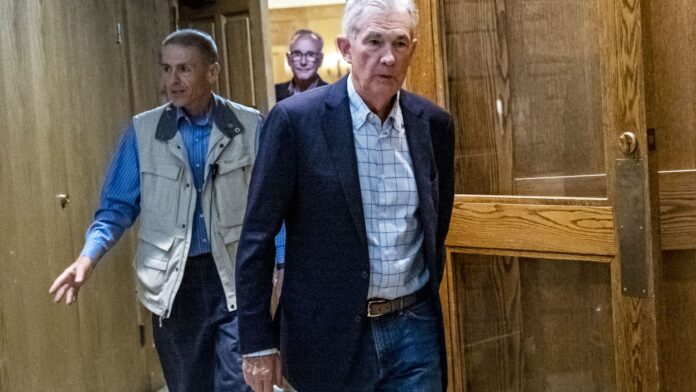

Federal Reserve Chairman Jerome Powell’s comments last week in Jackson Hole, Wyoming, have sent global bond markets into a slump. Powell spoke Friday, capping off the central bank’s economic symposium. In his speech, he noted that the Fed will continue to raise interest rates to curb high inflation, but that the U.S. economy would likely see some pain ahead . The hawkish stance surprised investors and led to a bond-selling rout. Bond yields rise as prices fall. Now, the Bloomberg Global Aggregate Index, a key fixed income benchmark, is within one percentage point of trading in a bear market. This means the benchmark, which tracks total returns of both investment-grade government and corporate bonds, is almost down 20% from its most recent peak, hit in January 2021. If bond prices fall further and slip 20% from the recent peak, it will be the first time that bonds have been in a bear market since 1981. Bonds and stocks falling Bonds have struggled this year and have generally lost value, trading in lockstep with equities instead of diverging. In the first half of the year, both asset classes posted their worst performances in decades and have continued to struggle since. “The Bloomberg [aggregate index] would have its worst year by a factor of three if we ended this year here,” said Mark Hackett, chief of investment research at Nationwide. In June, the S & P 500 fell into a bear market , closing down more than 20% from its record high sent in January. Since, the index has fought to recover, enjoying a brief rally in July as investors hoped the Federal Reserve would consider dialing back its policy tightening measures . Stocks have also slumped since Friday’s speech from Powell, which cast doubt on rate cuts next year. The S & P 500 is still in a bear market. Bonds slipping on Fed speak Yields ticked up after Powell’s speech, sending prices down — although not at the same pace as stocks. “Although the stock market sold off sharply following Fed Chair Powell’s Jackson Hole speech last week, bond yields only rose modestly as the bond market has already been pricing in an aggressive pace of rate hikes,” Collin Martin, fixed income strategist at Charles Schwab said in an email Tuesday. He added that while yields on the U.S. 2-year Treasury hit the highest level since 2007, markets are still pricing in a peak Fed funds rate of about 3.8%. “The Fed is committed to bringing inflation down, even if that means slower economic growth and a rising unemployment rate,” he said. More Fed speak added pressure to bond markets Tuesday. New York Federal Reserve President John Williams said in a speech that the U.S. will need restrictive policy for some time , pushing back on the idea that the central bank will cut rates next year. Bond markets are now pricing in a nearly 75% chance that the Fed will raise interest rates by at least three-quarters of a percentage point at the next meeting in September. In the coming weeks, the U.S. will get new data on the labor market and inflation that will inform the Fed’s moves at the next meeting. Global bonds under pressure Outside the U.S., other central banks are also dealing with the highest inflation in decades and adjusting monetary policy as they see fit. Earlier in August, the Bank of England handed out a half-percentage point interest rate hike , its largest since 1995, on its own quest to fight inflation. Last month, the European Central Bank raised its own rates by half of one percentage point to zero, and this week leaders made the case for another large hike in September. That’s sent yields on U.K. and German 2-year government bonds higher. The yield on the U.K. 2-year bond is 2.996%, the highest since 2008. In addition, the war in Ukraine, fluctuating energy prices and the continued pandemic are all weighing on bonds.

© heardonwallstreet.com