Sam Bankman-Fried, CEO and Founder of FTX, walks near the U.S. Capitol, in Washington, D.C., September 15, 2022.

Graeme Sloan | Sipa via AP Images

Sam Bankman-Fried told Reuters he is still in the Bahamas, as rumors swirled overnight that the disgraced ex-CEO of the now-bankrupt crypto exchange FTX had run off to South America.

FlightRadar24 tweeted early Saturday morning that the one-time crypto billionaire was flying from Nassau to Argentina. The account cited tweets as its sourcing that it was Bankman-Fried aboard the flight in question. (Argentina has an extradition treaty with the U.S. and carried out an extradition as recently as October, so it is not an ideal destination for someone potentially looking to evade authorities in the U.S.)

related investing news

Reuters asked Bankman-Fried whether he had flown to Argentina, and he replied, “Nope,” by text. He added that he remained in the Bahamas, which became his full-time residence last year.

Speculation over SBF’s (a nickname given to the former FTX CEO) whereabouts come as authorities close in on Bankman-Fried and his failed crypto empire.

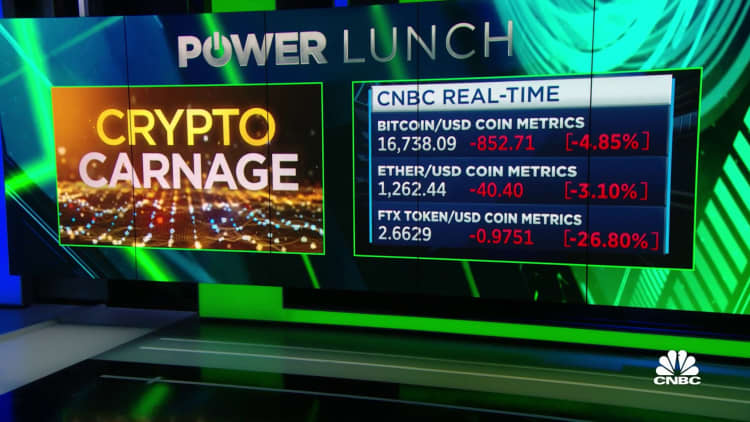

On Thursday, Bankman-Fried tweeted that he would be winding down his trading house, Alameda Research, and then on Friday, FTX — the digital asset exchange that Bankman-Fried founded in 2019 — filed for Chapter 11 bankruptcy protection in the U.S. That same day, Bankman-Fried stepped down as CEO. The Financial Times is reporting that a day before filing for bankruptcy protection, FTX’s global exchange had $900 million in “easily sellable assets” against $9 billion of liabilities.

It was a very swift fall from grace for FTX this week.

Earlier this year, the exchange was valued at $32 billion, and Bankman-Fried was billed as crypto’s white knight as he bailed out multiple digital asset companies. Now, its ex-CEO is reportedly facing probes by the Department of Justice, the Securities and Exchange Commission, and the Commodity Futures Trading Commission. Meanwhile, the bankrupt exchange appears to have been the target of a hack overnight.

— CNBC’s David Sucherman contributed to this report.